Bitcoin, after soaring through much of last year, has had a tough start to 2022—despite some huge bitcoin price predictions.

The bitcoin price hit lows of $32,000 per bitcoin in January, down from a peak of around $70,000 per bitcoin, but has recently bounced back, climbing over $45,000 for the first time in over a month.

However, banking giant JPMorgan has calculated bitcoin’s “fair value” to be far lower than its current price—and warned bitcoin’s “boom and bust cycles” are its biggest challenge when it comes to institutional adoption.

Sign up now for the free CryptoCodex—A daily newsletter for the crypto-curious. Helping you understand the world of bitcoin and crypto, every weekday

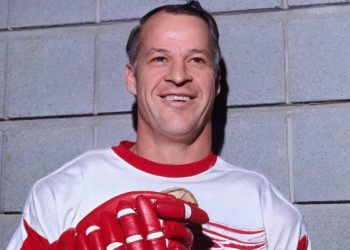

Wall Street giant JPMorgan has warned bitcoin could struggle to gain institutional adoption as … [+]

SOPA Images/LightRocket via Getty Images

“The biggest challenge for bitcoin going forward is its volatility and the boom and bust cycles that hinder further institutional adoption,” JPMorgan strategists wrote in a note to clients this week, it was first reported by Bloomberg.

JPMorgan’s calculations are based on bitcoin’s volatility in comparison with gold, with bitcoin roughly four times as volatile. However, if bitcoin’s volatility differential narrows to just three times gold’s, the bitcoin price fair value rises to $50,000. Over the longer term, JPMorgan has maintained its huge $150,000 bitcoin price prediction—a price that would give bitcoin a market capitalization of $2.8 trillion and put it on par with all gold held privately for investment purposes.

“With no fundamental value, like commodities,…