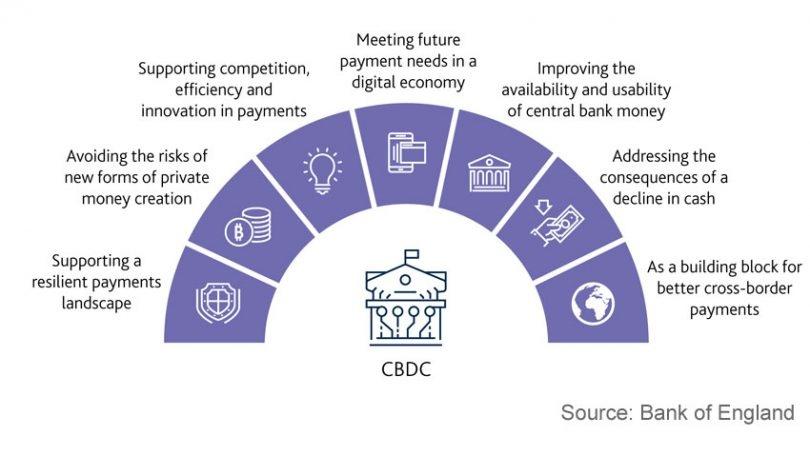

CBDC vs. Crypto

No matter how much anyone might love Bitcoin or crypto and for what it stands – no central authority or control – the fact is that just about everyone will prefer a government backed CBDC that is legal tender than a corporate crypto like Circle.

CBDC are government-backed, legal tender and on par 1-to-1 with a national currency that is already used as everyday money and is generally considered as a point-of-reference to purchasing power and value. Simply put, a one US dollar note will be exactly as one CBDC/Digital Dollar, soon-to-be-issued by the US Federal Reserve, according to ”Project Hamilton”, which is a joint exploration by the Federal Reserve and Massachusetts Institute of Technology’s Digital Currency Initiative.

According to CBDCtracker.org, the first ever nationwide functional CBDC is the “Sand Dollar” of the Bahamas, followed by the 2021 launch and imminent roll out early 2022 of Jamaica’s “Jam-DEX”. Around the same time in October 2021, Nigeria launched their CBDC by the name eNaira, issued by the Central Bank of Nigeria, backed by law and legal tender in Nigeria.

The Digital Yuan is still in the pilot phase – currently available in 23 cities and used by a fifth of the Chinese population – but it has proven to be functional so far. Unlike CBDC standards, it is not a blockchain-based decentralized ledger (DLT) but rather a “centralized” CBDC, issued and supervised by the “People’s Bank of China” (China’s Central Bank).

Bitcoin is legendary; the first crypto that rose from obscurity to the most used crypto of all times as well as dominating 50% plus of the crypto market cap, pushing it to $3 trillion sometime in November 2021. The disadvantage of Bitcoin – or any crypto for that matter – is being unregulated, unstable and volatile in value. Even “stable-coins” have not lived up to their name. TerraUSD which was pegged nearly exactly to the US$,…